In Marion County, 21.9 percent of single-family rental homes are owned by out-of-state investors, with 14.4 percent owned by mega-investors.

Eric Weddle / WFYISingle-family rental homes in five Central Indiana counties have been targeted by out-of-state investors, according to a new report from the Fair Housing Center of Central Indiana.

Over 20,000 rental homes are owned by out-of-state investors — that’s about one in four homes, with 16.2 percent owned by mega-investors.

“Mega-investors” are companies that own at least a thousand rental homes in the five-county area. Some target newly-listed rental properties within hours and make cash offers within days. They tend to go after low-priced homes, which can be older or in disrepair.

The FHCCI analysis identified seven mega-investors in Central Indiana, finding that only one is Indiana-based. The rest are out-of-state companies operating as landlords.

This trend is not only happening in Indiana. A 2022 investment firm analysis predicted that ownership of the country’s rental properties may increasingly consolidate under corporate landlords. The analysis estimated that by 2030, corporate landlords may own 7.6 million properties — or over 40 percent of all single-family rental homes in the country.

The FHCCI analysis is limited to single-family rental properties and doesn’t include multi-family rental homes that would have more than one unit, such as duplexes or apartment complexes. It focuses on Marion, Hamilton, Hancock, Hendricks, and Johnson counties. The center purchased county tax assessor property ownership data from all five counties through a private data provider to complete the report.

The FHCCI is a local nonprofit that advocates for “equal housing opportunity and access in a bias-free and open housing market, free of housing discrimination.” They provide housing counseling, education, community investment and neighborhood stabilization work, and advocate for public policy.

In order to determine ownership, they had to match addresses, as investors often hide ownership through a snarl of obscure limited liability companies, or LLCs, that are often interrelated.

To make matters more complicated, some of these companies are owned by private equity firms, which can insulate themselves from tenant legal liability through their structure. These firms often prioritize short-term profits. And they’re exempt from filing public financial disclosures to the federal government.

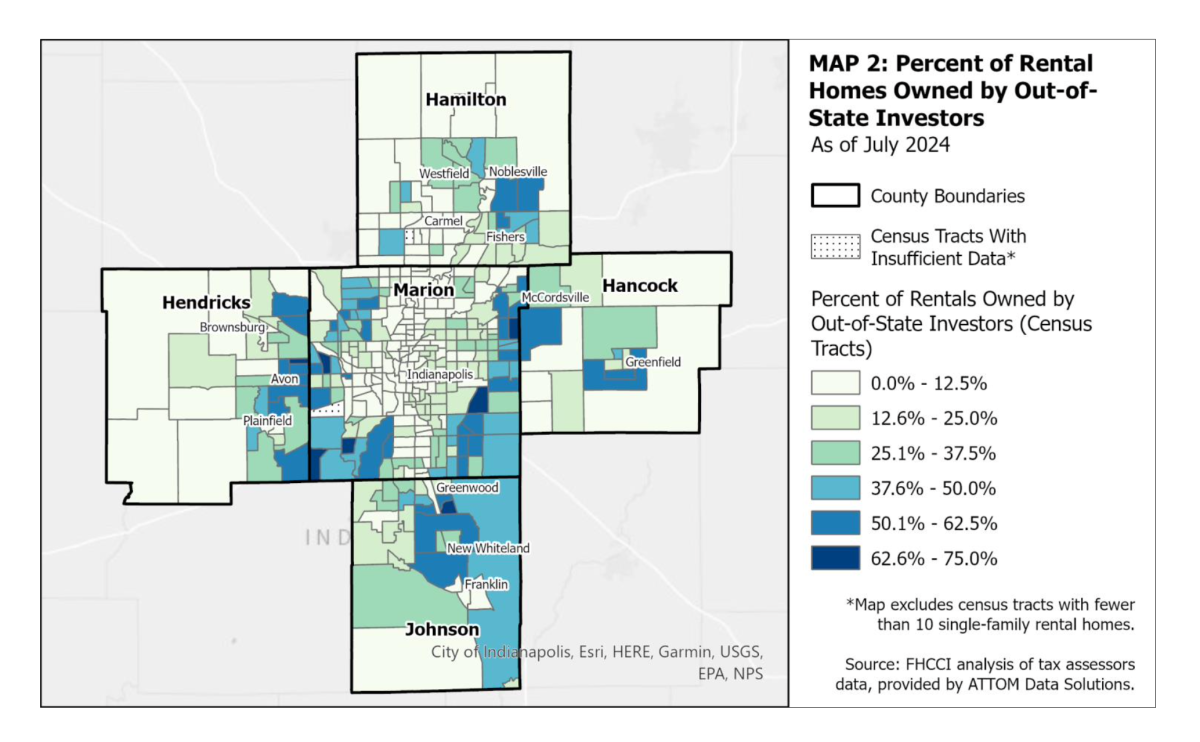

Marion County has higher rates of investor ownership than nearby counties

In Marion County, 21.9 percent of single-family rental homes are owned by out-of-state investors, with 14.4 percent owned by mega-investors. About 48 percent of all of these homes are owned by investors in general.

“These are companies that are targeting affordability. We see how the Far East Side, Lawrence and Marion County — the South Side — [are] really being bought up quite a bit, particularly by mega-investors,” said Amy Nelson, the executive director of the FHCCI.

The companies scope specific, low-value neighborhoods and purchase homes in clusters rather than dispersed throughout the county, said Nelson. The closer one gets to Central Indianapolis, the greater the percentage of properties owned by local investors.

How out-of-state investor ownership of rentals can impact communities

When investors speculate on rental property, tenants and the local community can experience negative effects, according to the FHCCI report.

It estimates that out-of-state investors are collecting $36 million in rent from the five counties each month, which amounts to a drain of approximately $438 million in rent out of Indiana per year.

Indiana tenant-landlord law doesn’t require out-of-state landlords to have local property management, the report said, which can lead to property maintenance and repair issues for tenants in these units. It said research found negative impacts on tenants and communities around the country, noting several studies.

A 2023 FHCCI report that focused on Marion County found that large out-of-state investors filed more evictions and had notably higher counts of health code violations.

Other research has demonstrated negative effects, including that out-of-state investor purchases of multifamily rental housing contributed to an increase in evictions and segregation in one Atlanta neighborhood.

Another study in Boston looked at the snaggle of rental property ownership and found that the top one percent of landlords were responsible for 31 percent of housing quality complaints in 2019 and over half of eviction filings in 2016.

Four of the seven mega-investors in Central Indiana are owned by private equity firms: FirstKey Homes, Progress Residential, My Community Homes, and Tricon Residential.

Private equity firms investing in single-family rental homes can also harm the communities where they own property. The Fair Housing Center said Central Indiana communities have dealt with out-of-state investors that have neglected properties.

“Tenants of mega-investor landlords in Central Indiana have spoken to the FHCCI about homes with roofs that were caving in, incorrectly installed pipe and wire systems, homes sliding on cracked foundations, faulty sealing causing high heat bills, and broken furnaces leaving families in the cold,” the report said.

It also noted some practices private equity has been responsible for include poor conditions, serial evictions, “junk” fees, high rents, and restrictive application policies.

When investors buy up lower-value homes in a neighborhood, they can lock out lower-income homebuyers from affordable housing.

Policy solutions

Investor purchases of single-family homes seem to be slowing down, according to the report, but the analysis found that it’s not stopping. At the same time, home sales overall have decreased in recent years, as well as the availability of affordable homes.

Indiana Code provides less protection for renters and is friendlier to landlords than other states. The FHCCI notes that some changes in law would better protect renters and real estate from the potential negative effects of out-of-state investors. It offers the following recommendations:

- Increase ownership transparency and data access through rental registries and landlord licensing programs

- Keep residents safe in their homes by using tools that are designed to be effective with large corporate actors

- Protect tenants from retaliation and abuses of power by implementing anti-retaliation, anti-harassment, and right-to-organize policies so that they can stay in their homes and exercise their rights

- Address the root cause of the problem: limit speculation by corporate landlords and make it harder to gamble on communities or profit from unhealthy housing

- Resource public options that are permanently affordable and community-controlled

It also advocates for the state to enact a rent escrow law, a move that has failed in recent legislative sessions. It would allow tenants to withhold rent in a court-held account if a landlord doesn't make needed repairs. Other measures could minimize harm to communities, add transparency around investor owners and create right-to-counsel.

“This includes the creation of effective landlord registries, mandatory landlord licensing with proactive inspections for habitability, required local property management, and limits on the number of home purchases by private equity companies,” said the report.

When you experience issues with your landlord, Nelson said there are a couple things you can do. With an issue of habitability, contact your local health or safety inspector to request an inspection. You can file a complaint with the Indiana Attorney General. FHCCI will also give guidance or make referrals, including for legal services.

If you have a tip about housing issues in Central Indiana, contact WFYI data journalist Zak Cassel at zcassel@wfyi.org.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.