Analysts differ on whether proposed tax cuts will provide a net benefit to workers at Indiana factories and other businesses.

Annie Ropeik/IPB NewsStakeholders in Indiana are already weighing the GOP tax plan’s potential effect on workers.

Indiana Manufacturers Association lobbyist Andrew Berger says the plan’s most important pillar is its 20 percent corporate tax rate. He says it’ll let businesses make decisions about growing and investing based on what really matters.

“Not, ‘how do I best effectuate my tax liability?’” he says. “That’s what we’re trying to get out of this investment decision-making process.”

There’s no guarantee the cut will trickle down to workers through wage growth or new jobs, as President Donald Trump has promised.

But Berger says the cut, combined with a theoretically simpler tax system, will create stability that should benefit everyone.

“Certainty drives investment,” he says. For manufacturers, he says that could mean “equipment, hiring, added lines – on down the list. All of that will be more likely to happen in the United States with tax reform than it would otherwise.”

Policy analyst Andrew Bradley, with the Indiana Institute for Working Families, says the only guarantee he sees in the GOP plan is the cuts. And he says those aren’t equitable.

“The top 1 percent in Indiana get a tax cut above $54,000 a year. That’s more than the statewide median household income,” Bradley says. “But by comparison, the bottom 60 percent of middle class and working families together get less than 13 percent of the cuts.”

He says that amounts to less than $6 a week in savings.

And Bradley says that won’t offset how the GOP plans to pay for the tax breaks – through cuts to safety net programs like Medicaid and nutritional assistance, and by reducing deductions for things like medical bills, moving expenses and interest on student loans and mortgages.

“If the claim is that cuts to higher earners supercharge the economy – Indiana doesn’t have that many high earners, so we’re actually getting sapped more from our state economy,” Bradley says.

On the other hand, Indiana may not be as badly affected as some by the loss of the state and local tax deduction – where hikes in those taxes get refunded to taxpayers – because it’s already a comparatively lower-tax state.

Most analysts haven’t yet released new state-by-state breakdowns about the impacts of the GOP tax plan, but the Institute on Taxation and Economic Policy says the latest version of the plan is roughly the same as the one outlined this past summer, when they released this fact sheet about Indiana:

DONATE

DONATE

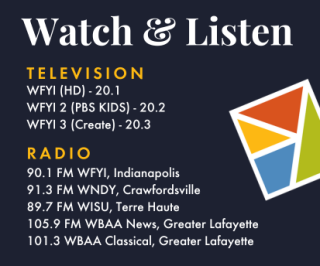

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.