Lawmakers this session eliminated what they saw as a quirk of state law – sales tax on food sold in vending machines.

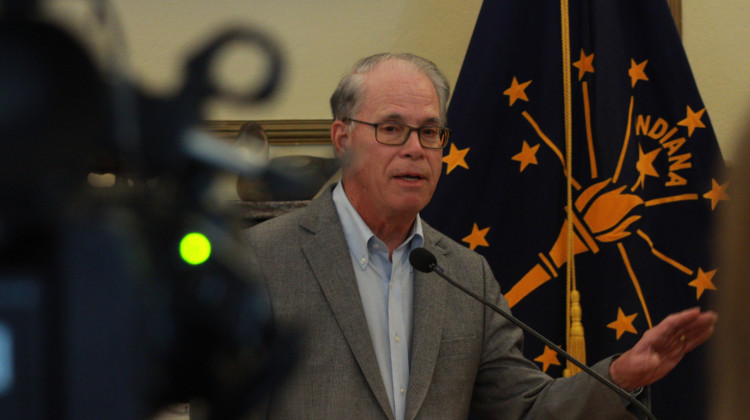

Most food bought at the grocery store is exempt from the state sales tax, says Rep. Dave Ober (R-Albion).

“But some of those same items, if they’re purchased through a vending machine, are charged the seven percent tax,” Ober says.

That will change, starting next July. Sen. Travis Holdman (R-Markle) says lowering the cost of what vending machine owners have to remit to the state should impact prices in those machines.

“Hopefully there will be at least not an immediate increase because they should be able to level out or decrease in costs,” Holdman says.

The change doesn’t apply to candy or soda, which is taxed no matter where you buy it.

The vending machine food sales tax elimination is expected to cost the state about $5 million per year.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.