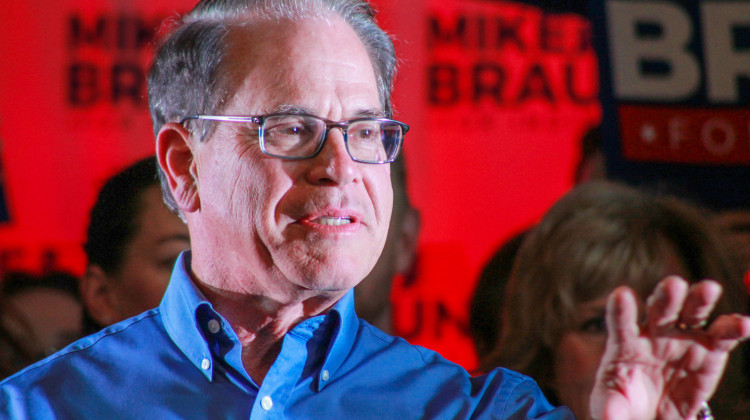

U.S. Sen. Mike Braun (R-Ind.) unveiled a proposal as part of his gubernatorial campaign that would make major changes to the homestead tax deduction for Indiana homeowners.

Brandon Smith / IPB NewsRepublican gubernatorial candidate Mike Braun has unveiled a plan that makes major changes to the state’s property tax system, saying “nothing is more important” than controlling costs so that homeowners can stay in their homes.

Right now, part of the calculation for property tax bills is the standard homestead deduction — 60 percent of your home’s gross assessed value or $48,000, whichever is lower — and then a supplemental homestead deduction, which is 40 percent of the remaining assessed value.

Braun’s plan removes the cap on the standard homestead deduction and gets rid of the supplemental deduction for all homes worth at least $125,000. For homes below that amount, the cap would remain, but they would get a supplemental deduction of 60 percent.

Property tax rates are more complicated, and his plan doesn’t touch those. But the bottom line is, for a $200,000 home at a two percent property tax rate, you’d save $224 this year under his proposal.

Going forward, the plan would also cap property tax bill increases at 2 percent for older homeowners, low-income Hoosiers, and families with children under age 18 – and at 3 percent for everyone else.

Property taxes fund local governments and schools, not the state — and the Braun campaign won’t say how those lost dollars would be replaced. It said it hopes his plan starts a conversation around “delivering effective government services without allowing budget creep and overburdening homeowners.”

Join the conversation and sign up for the Indiana Two-Way. Text "Indiana" to 765-275-1120. Your comments and questions in response to our weekly text help us find the answers you need on statewide issues and the election, including our project Civically, Indiana.

Democratic gubernatorial candidate Jennifer McCormick said Braun voted to increase property tax bills in the past and accuses him of saying anything to get elected.

Libertarian Donald Rainwater said Braun’s plan only reduces increasing tax bills and doesn’t stop the increases entirely, which Rainwater’s proposal — released earlier this year — does.

Braun’s policy proposal does allow local referendums to increase property tax bills beyond the caps his plan would put in place. But those referendums would only be allowed in statewide, general elections — not in primaries, and not in municipal election cycles.

It would also require local governments to include more information in those referendums — specifically, how much the proposed tax increase would raise the median tax bill.

Brandon is our Statehouse bureau chief. Contact him at bsmith@ipbs.org or follow him on Twitter at @brandonjsmith5.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.