The measure now goes back to the Senate, which can send it to the governor or take it to conference committee for more work.

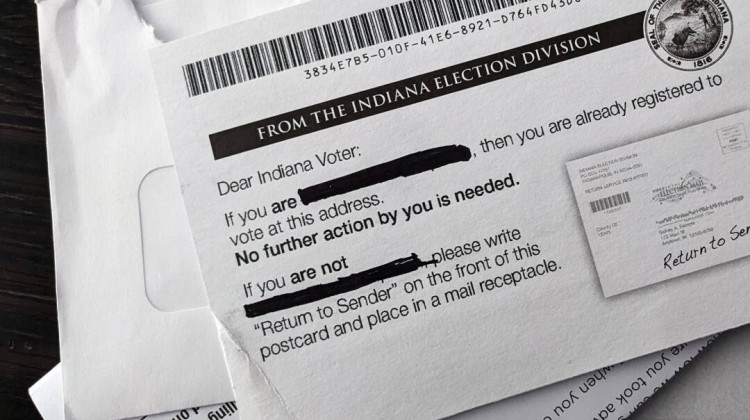

Lauren Chapman / IPB NewsHouse Republicans passed a sweeping overhaul of property taxes Thursday. They say Senate Bill 1 will provide more transparency and provide relief for homeowners after several years of assessed value growth.

The most up-to-date fiscal analysis of the measure reports — compared to our current system — local governments will lose out on nearly $1.8 billion over the next three years.

But House Speaker Todd Huston (R-Fishers) said that's not a cut.

"I'm going to push back on everybody that says, 'Well, we would have collected X.' What did you— before you say it's a cut, what did you collect last year? And what are you collecting this year?" Huston said.

The fiscal analysis shows a mixed bag: At the county level, 23 counties will see decreased net levies from this year to 2026. But the other 69 will see more money — the most for Marion, Lake and St. Joseph counties.

It becomes more mixed the more local unit of government you narrow down to.

For example: From 2026 to 2028, school districts statewide will lose out on $744.4 million under the proposed bill — compared to the current tax system. This year, schools statewide will generate nearly $4.4 billion from taxes. Under the bill passed by the House, that would remain largely stagnate, generating about $17 million more in 2026.

Which means some school districts will grow, some — as Huston acknowledged — will face actual year-over-year funding cuts, and some will remain largely in the same place.

Join the conversation and sign up for our weekly text group: the Indiana Two-Way. Your comments and questions help us find the answers you need on statewide issues, including our project Civically, Indiana and our 2025 bill tracker.

Still, Huston said it's a homerun.

"What do you provide to make sure that local communities have to provide the type of support—those types of services their constituents expect?" Huston said. "I think we found that balance."

House Democrats say it's a scam. Rep. Greg Porter (D-Indianapolis) said it shifts the financial burden from homeowners and property taxes to working Hoosiers and their local income taxes.

"You're giving it over here on the left hand, you're saying 'We're going to give you this tax break.' But you're forcing local income taxes at the government level to provide the services that people need," Porter said.

Instead of generating funding from property taxes, the overhaul tells local units of government to generate it from local income taxes. House Democrats say local governments — like counties, cities, towns and townships — have new tools at hand to handle the shift. But they say schools don't.

Republicans say the measure will provide property owners an up to $300 credit on their property tax bill. It cuts the cap on local income taxes from 3.75 percent to 2.9 percent. And it makes changes to the business personal property taxes that Republicans say is designed to mostly benefit small businesses.

The measure now goes back to the Senate, which can send it to the governor or take it to conference committee for more work.

Lauren is our digital editor. Contact her at lauren@ipbnews.org or follow her on Bluesky at @laurenechapman.bsky.social.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.