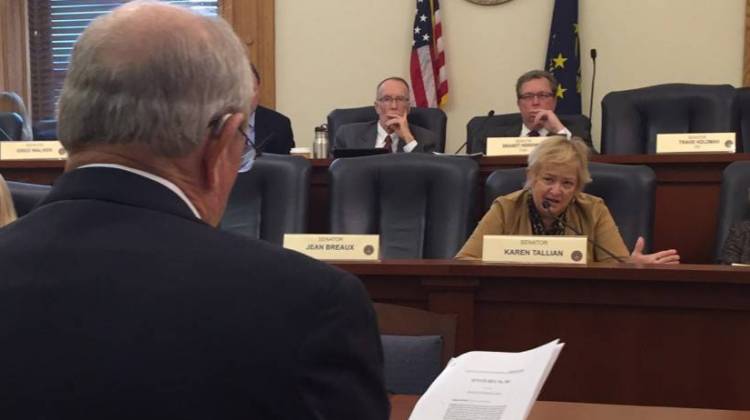

A Senate committee approved a bill that would require online retailers to collect sales tax for Indiana even if they have no physical connection to the state. Online retailers are only required to collect sales tax for a state if they have a physical connection to that state. Otherwise, customers must pay the sales tax on their own –which rarely happens in part because many people don’t know that. Sen. Luke Kenley’s (R-Noblesville) bill would require online retailers to collect sales tax

IPBS-RJCA Senate committee approved a bill that would require online retailers to collect sales tax for Indiana even if they have no physical connection to the state.

Online retailers are only required to collect sales tax for a state if they have a physical connection to that state. Otherwise, customers must pay the sales tax on their own –which rarely happens in part because many people don’t know that.

Sen. Luke Kenley’s (R-Noblesville) bill would require online retailers to collect sales tax if they sell $100,000 worth of product in Indiana per year, or have at least 200 transactions with Hoosier customers in a year.

Kenley says it’s not a tax increase, but collecting a tax that’s already owed.

“It would increase our sales tax collections by over $200 million a year,” Kenley says.

There are questions about the legislation’s constitutionality – and Kenley acknowledges that a federal court will have to weigh in before Indiana can start enforcing the bill. Sen. Jim Buck (R-Kokomo) says that uncertainty is why he was the lone ‘no’ vote in committee.

“Those individuals who want to disregard it can do so,” Buck says. “So what we’re doing is asking for those that willfully want to pay it, to pay it. They can do that now.”

The bill now heads to the Senate floor.

DONATE

DONATE

View More Articles

View More Articles

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.