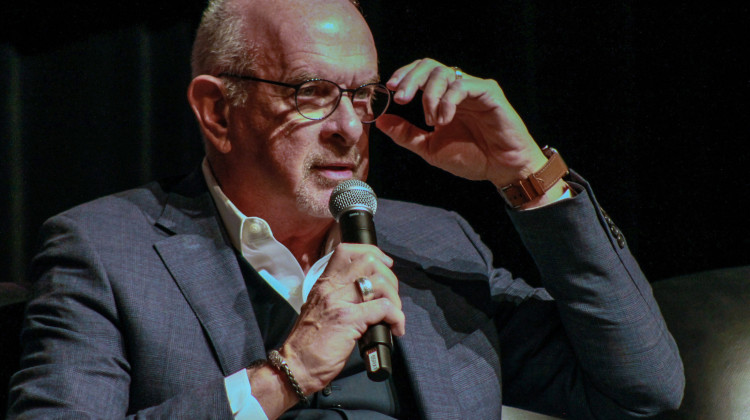

Sen. Travis Holdman (R-Markle) regularly advocates for Indiana to reduce or even eliminate its individual income tax.

Brandon Smith / IPB NewsIndiana is in the midst of a five-year reduction of its individual income tax rate. A bill unanimously approved by a Senate committee Tuesday would continue to cut the rate after that — but only if state revenues grow.

Indiana’s individual income tax rate will go down to 2.9 percent in 2027, the third lowest rate in the country for states with an income tax.

Sen. Travis Holdman’s (R-Markle) bill would automatically lower the tax rate further by 0.05 percent every even-numbered year, beginning in 2030 — but only if state revenues grow by at least 3 percent in the previous even-numbered year.

“Which allows for the General Assembly to take proactive steps to stop or to suspend the reduction in the individual income tax rate, should they choose to do so,” Holdman said.

READ MORE: How do I follow Indiana’s legislative session? Here’s your guide to demystify the process

Join the conversation and sign up for our weekly text group: the Indiana Two-Way. Your comments and questions help us find the answers you need on statewide issues, including our project Civically, Indiana and our 2025 bill tracker.

For a household earning $100,000, that would be a savings of $50 a year. It would cost the state hundreds of millions of dollars per year in revenue.

The Indiana Chamber of Commerce and the Indiana Manufacturers Association both supported the bill, saying it would help Indiana’s tax climate remain competitive.

Brandon is our Statehouse bureau chief. Contact him at bsmith@ipbs.org or follow him on Twitter at @brandonjsmith5.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.