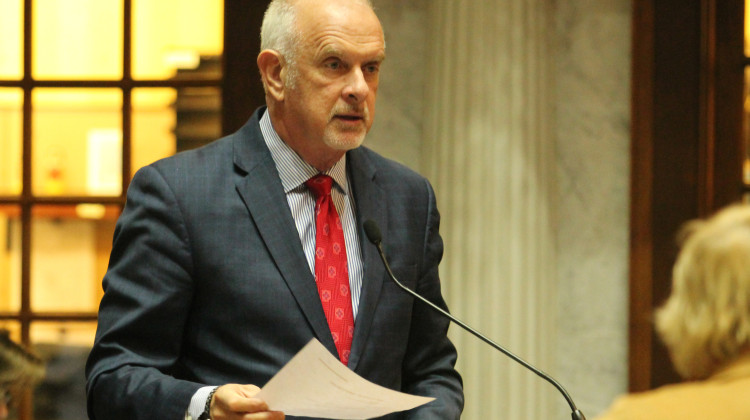

Sen. Travis Holdman (R-Markle) chairs the Senate Tax and Fiscal Policy Committee. He said the committee will vote on bills concerning property taxes and school referendums in two weeks.

Lauren Chapman / IPB NewsSchool officials and representatives raised concerns to state lawmakers Tuesday about how some tax reform measures could hurt public school districts.

Schools receive a large portion of their funding through local property taxes, and some advocates said reducing those taxes without replacing that funding could leave some schools in a financial crisis.

The Senate Tax and Fiscal Policy Committee heard SB 443, a bill that would reduce the tax burdens on small businesses, and SB 9, a bill that would change the formula that determines the maximum increase in property taxes, among others.

The state estimates public schools could lose nearly $356 million within the first three years of both of those bills taking effect.

Jerell Blakeley is the director of government, community and racial and social justice at the Indiana State Teachers Association. He said ISTA supports tax reform, but the union wants lawmakers to identify replacement funding for schools.

“A lot of these bills are death by a thousand cuts when you compound them with other bills and you start seeing dramatically negative revenue impacts,” he said.

Blakeley said without consistent funding, many schools would have to cut back teacher pay, among other things. Representatives from school districts across the state expressed similar concerns.

Mooresville Schools Superintendent Jake Allen said costs have increased significantly in recent years for things like fuel, school buses and insurance. The district’s revenue has also increased, but Allen said he is concerned the tax reform bills could close that gap.

“We are a fiscally conservative school corporation in a fiscally conservative community, and we have worked hard to keep tax rates well below the state average. [We’re in] the bottom 15 percent of the state,” he said. “We want to keep it that way while also doing our best to provide the highest quality of education through competitive wages.”

School advocates also spoke against SB 8, a bill that would restrict when districts could ask taxpayers to approve property tax referendums. Some schools rely on referendums to fill funding gaps.

READ MORE: Why do some schools need referendums? Expert says property tax caps complicate funding

Join the conversation and sign up for our weekly text group: the Indiana Two-Way. Your comments and questions help us find the answers you need on statewide issues, including our project Civically, Indiana and our 2025 bill tracker.

The bill would restrict districts from asking for referendums outside general elections or primary elections that occur during general election years. It would also require districts to wait one full calendar year after the end of an operating or safety referendum to ask for another, and it would add information to the ballot question about how much property tax revenue would be collected each year.

Duneland School Corporation Superintendent Chip Pettit told lawmakers that restricting school referendums is taking away voters’ choice to make improvement to their districts.

“The Duneland community has overwhelmingly chosen to maximize teacher compensation through the referendum process,” he said. “Our beginning teacher pay is at $54,000 a year, and we don’t apologize for that. But without the operating referendum, that would be a pipe dream. Our taxpayers have chosen to do more than the minimum for the benefit of our students. Please do not disenfranchise that choice.”

Other school officials and advocates said adding language to a ballot question that is already long and complicated could further confuse voters at the ballot box. They requested that lawmakers consider shortening the question instead.

The Senate Tax and Fiscal Policy Committee did not vote on any bills this week. Sen. Travis Holdman (R-Markle), the committee chair, said the group will reconvene in two weeks after drafting amendments to address some of the concerns discussed during Tuesday’s meeting.

Kirsten is Indiana Public Broadcasting's education reporter. Contact her at kadair@wfyi.org or follow her on Twitter at @kirsten_adair.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.