The amount Americans spend on buy now, pay later products increased about 700 percent in roughly the last four years.

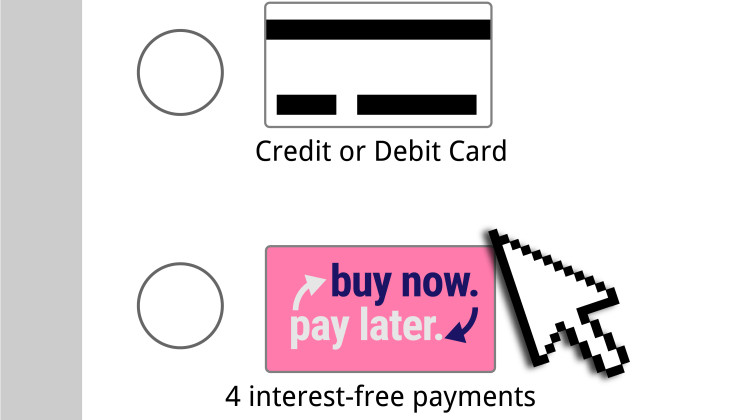

Lauren Chapman / IPB News“Buy now, pay later” products have become more common — customers can pay a portion of the purchase price up front, and then pay the rest in installments over several weeks, with no interest.

The Indiana Community Action Poverty Institute said buy now, pay later carries plenty of risk, particularly for low-income consumers.

The amount Americans spend on buy now, pay later products increased about 700 percent in roughly the last four years. Institute Research Coordinator Zia Saylor said there is obvious appeal to buy now, pay later.

But she said there are also downsides, which often aren’t made clear.

“If you don’t have sufficient funds to pay for something, then the buy now, pay later vendor will continue to represent that charge,” Saylor said. “And they can do that up to eight times, which is very high in overdraft fees or nonsufficient funds fees that you will be charged by your bank.”

READ MORE: How do I follow Indiana’s legislative session? Here’s your guide to demystify the process

Join the conversation and sign up for the Indiana Two-Way. Text "Indiana" to 765-275-1120. Your comments and questions in response to our weekly text help us find the answers you need on statewide issues, including our project Civically, Indiana.

More than a dozen states have taken steps to protect consumers who use these products. Indiana isn’t one of them.

Saylor said the state can require so-called “installment lenders” to be licensed.

“These are really important ways to basically ensure that the state government is involved in regulating and ensuring that there is a level of compliance,” Saylor said.

Saylor said buy now, pay later marketing should be more closely regulated, as many lenders advertise them as “risk-free alternatives to credit.” Saylor said these products do carry risk and can show up negatively on consumers’ credit reports.

Brandon is our Statehouse bureau chief. Contact him at bsmith@ipbs.org or follow him on Twitter at @brandonjsmith5.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.